Though solar panels can save you a lot of money on your energy bills in the long run, they come with some high upfront costs. A solar panel payment plan can make going solar more affordable by spreading the cost out over several years.

If you don’t have an extra $20k laying around to make a cash purchase for your solar panels, you’ll need to find a way to finance your solar power system that includes an affordable monthly payment plan. There are several financing options for homeowners.

Personal Loan or Personal Line of Credit

Taking out a personal loan or personal line of credit is a type of unsecured financing, meaning you do not have to put up any collateral. The repayment period is typically between 2-7 years and the APR varies depending on personal information such as your credit score, income, and previous debt.

If you have excellent credit, you are likely to get an APR as low as 6%, though it can go up to 36%. Depending on your terms, your repayment may be more than your loan amount.

The pros of taking out a personal loan or line of credit are fast funding, short repayment terms, and no collateral needed. However, some cons of this financing option include high rates (unless your credit is good enough to qualify you for low-interest rates), the interest isn’t tax deductible, and the lender may charge an origination fee.

Home Equity Loan

This type of loan is a secured loan, meaning that collateral (your house) is required. With this loan, you can borrow up to 80% of your home’s value minus what you owe on your mortgage. For example, if your home is worth $300,000 and you owe $200,000, you are able to borrow up to $40,000.

This is considered a second mortgage, meaning that you will get lower interest rates than with personal loans. Another perk to this financing option is that your interest is tax deductible.

However, there are some downsides to this option, including longer repayment terms and the fact that your home is used as collateral. That means if you are unable to pay, you could lose your home.

Home Equity Line of Credit (HELOC)

Just like with a home equity loan, a HELOC uses your house as collateral and allows you to tap into its equity and use it as a lower-interest credit card. The difference between this and a home equity loan is that this option has variable interest rates, while the home equity loan is a second fixed-rate mortgage.

Solar Loan

As the name suggests, solar panel loans are home improvement loans specifically for solar equipment installation. This is a great option if you are looking to install a solar energy system with little to no down payment.

The incentives in your area will determine if your loan payment will be lower than your typical electric bill from the utility company. Because you are the owner of this renewable energy source, you are eligible for tax credits like the federal solar tax credit, among others.

You can qualify for either a secured loan or an unsecured loan, depending on several factors such as your credit score, current income, and debt. With an unsecured loan, you will have a higher interest rate than you would with a secured loan, but you would not have to put up any collateral.

Property Assessed Clean Energy (PACE) Loans

A PACE loan (or property-assessed clean energy) is a way to borrow money for energy-efficient home upgrades by increasing your property tax. The collateral for this type of loan is the property itself.

Unlike other solar loans, the debt from a PACE loan is tied directly to the property, rather than the owner. This means that when the property changes hands, the remaining balance remains intact with the property.

PACE loans do not require a down payment, nor do they involve a regular monthly payment. Instead, the loan is repaid via property assessments as an addition to the regular property taxes. They are spread out over a period of time (usually between 10 and 20 years) based on the loan amount.

This solar panel financing option for residential properties is available in California, Florida, and Missouri. However, commercial PACE loans are available in 30 states, plus D.C.

Energy Efficient Mortgage Program

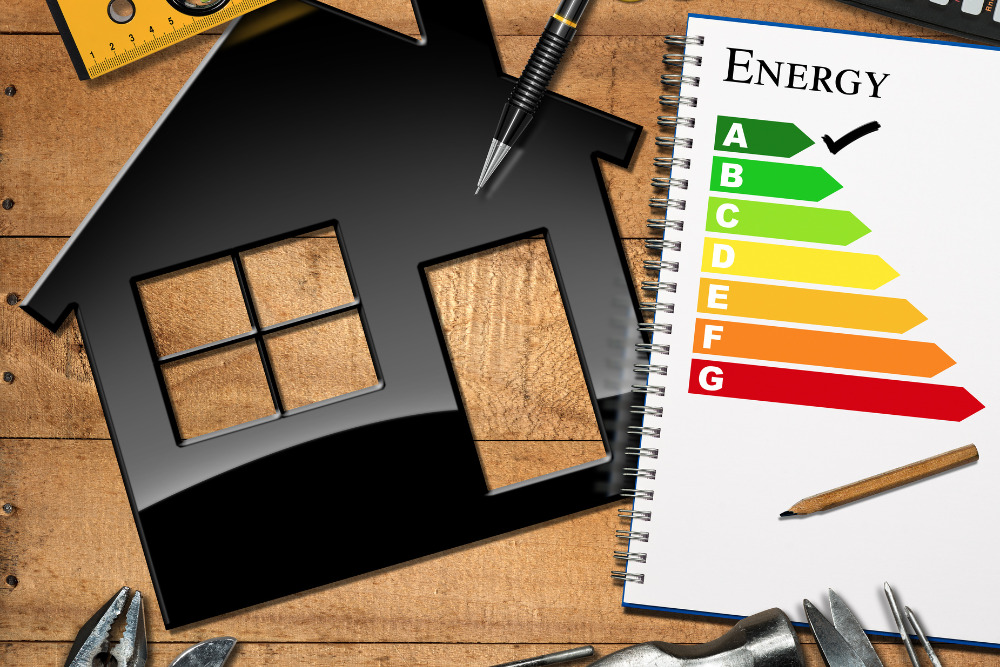

An EEM (energy-efficient mortgage) can be used by borrowers to purchase a new home or refinance a home that is already energy efficient. It can also be used to finance home energy efficiency improvements, such as solar panel installation.

To obtain an EEM, a homeowner needs to have a professional conduct a home energy assessment. This verifies to the lender that the home is, or will be, energy-efficient and provides them with the estimated monthly energy savings and the value of the energy efficiency systems being installed.

There are different types of EEMs available, including conventional EEMs, such as Fannie Mae’s Homestyle Energy Mortgage or Freddie Mac’s GreenCHOICE Mortgage, FHA (Federal Housing Administration) Energy Efficient Mortgage Programs, and VA EEMs.

Title I Home and Property Improvement Loans

This FHA loan option is a fixed-rate loan used for home improvements and repairs. The money can be used for anything that will make your house “more livable and useful,” according to HUD.

The maximum loan term is 20 years and the maximum loan amount is $25,000 for a single-family home. There are specific requirements for this particular loan type, which include:

- The house must have been built and occupied for at least 90 days.

- You have to own the home or have a long-term lease agreement.

- The loan must be verified as used for specifically intended property improvements.

- You must have a debt-to-income ratio of 45% or less.

- An annual FHA mortgage income premium will be charged or built into your interest rate at $1 per $100 of the amount of the loan.

You can apply with a mortgage lender for any FHA loan, though it is suggested that you shop around.

Solar Lease

A solar lease allows homeowners to finance solar energy with little to no upfront costs. You will have a fixed monthly rate that you will pay directly to the solar company and, in return, will be able to enjoy the benefits of lowering your utility bill.

This option is similar to leasing a car. You pay your monthly fee and you get to use the solar panels for as long as your contract determines. However, you are not the owner of the solar panels.

A typical lease agreement is between 15 and 25 years and includes maintenance and repairs of the panels. On the other hand, solar leases do not add any value to your home, and may even make it harder to sell as the new owner must assume the lease.

Solar Power Purchase Program (PPA)

A solar power purchase agreement is different from a solar lease in that you only pay for the power you use. Like with a lease, you are not responsible for the maintenance and upkeep of the panels, but you do not own them outright either.

You can use them for as long as your lease agreement is (which could be as long as the lifespan of the panels themselves). You will know exactly how much your power will cost because you pay a specific amount per kilowatt-hour used.

One thing to note is that a PPA could increase your home’s taxable value, meaning you may end up paying more in taxes even though you aren’t the owner of the system.

What Is The Average Payback Period For Solar Panels?

The average payback period for residential solar panels is between 6-9 years. However, this can vary due to several factors, including:

- The total cost of your solar panel system

- Tax credits, rebates, and other incentives

- Current electricity rates (areas with higher utility costs have a faster payback period)

What Is The Average Monthly Payment For Solar Panels?

There are several factors that will determine your average monthly payment. The most important thing when shopping for solar financing solutions is to make sure your payment is lower than your average monthly electricity bill.

Let’s say that you take out a loan with a 6% APR and the total cost of your solar system was around $22,000. With a payback period of 20 years, you are looking at around a $178 payment per month.

Current electricity bill: $250

Electricity bill with solar panels: $0

Solar loan monthly payment: $178

Monthly savings from day one: $72